Calculate depreciation on laptop

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Start by listing the value of any current assets assets that can easily be converted to cash like cash money owed to.

![]()

Asset Tracking Depreciation Monitor Assets Value

Add these amounts up and apply the total to the CCA balance you may have carried over from.

. Take a quick read through our QAs and see how your pressing depreciation questions can potentially be solved. If your profit exceeds the 250000 or 500000 limit the excess is typically reported as a capital gain on Schedule D. Get 247 customer support help when you place a homework help service order with us.

And as above suggest it will resolve your super question which there is no harm checking with HR. After filling out the order form you fill in the sign up details. What you paid for the equipment furniture structure vehicle or.

Cost of the fixed asset. If you use your laptop 100 for work over the life of its depreciation 2-3 years based on ato website you will get that 600 back in tax deductions plus whatever other expenses you claim. éÆGVÆ Ôø å u2½t¹ D _Øi4HÏÏL9QðÅýòäÜšpçÌïKÚPÚ ˆPÚ ³E¼âI_kP VÔ ¼ZfÍžùÝ xÇ DœÜm2 1 Ç xÝV À œTM 6n eTljø³ ÈËdEuÞx7 EìZpÿ Ë ÉºÊÄ8ÌiB2mÕóLù-8Ûàu ÎY ÅV1ZÔÅÀwØ _fe pwõOÆqfšŠEww Á_.

Cost of the fixed asset Sales tax Shipping and delivery costs Installation charges Other costs Cost basis. Ensure you request for assistant if you cant find the section. If you acquire ownership of a home as part.

To calculate your businesss total assets you first need to know what assets you have. To calculate SYD depreciation you add up the digits in the assets useful. There are several depreciation factors a business can use to determine the reduced value of an asset.

In many cases the salvage value is zero. After filling out the order form you fill in the sign up details. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

For tax depreciation different assets are sorted into different classes and each class has its own useful life. The number of years over which you depreciate something is determined by its useful life eg a laptop is useful for about five years. Ensure you request for assistant if you cant find the section.

You recover the costs through depreciation amortization or cost of goods sold when you use sell or. Second year we will calculate the depreciation on 160000 20 which will be 32000. Businesses residing in the US will also have to calculate depreciation based on the US.

To calculate CCA list all the additional depreciable property your business has bought this year. Depreciation rate for laptop is 6316. In accounting terminology it is called provision for camera or laptop.

Choose any inventory management solution plan thats right for you. The new rules allow for 100 bonus expensing of assets that are new or used. The number of years that the company will use the asset for the business.

Wear and Tear is the tax term for the decrease in value of an asset as it gets used. Lets take the example of a laptop with the initial value of 3000 expected final residual value 1000 and life span of 4 years. In the previous example we determined the ACV of your 13-inch laptop was 600 and the cost of a similar laptop is 1000.

1What is wear and tear or depreciation. For laptops this is typically two years and for desktops typically four years. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017.

Tax Code which allows businesses to take advantage of accelerated depreciation as specified by the. If the computer has a residual value in 3 years of 200 then depreciation would be calculated on the amount of value the laptop is expected to lose. Now that we know the depreciation rate we can calculate the depreciation amount during the useful life of the asset laptop Step 4.

Your tax professional can help you work out the rate of depreciation you can claim over the life of the asset. When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Depreciation 800 3 26667.

You then divide each year by this sum to calculate that years depreciation percentage. Depreciation schedule as per Companies Act during the useful life of asset laptop. Key Takeaways If you owned and lived in the home for a total of two of the five years before the sale then up to 250000 of profit is tax-free or up to 500000 if you are married and file a joint return.

Value of the asset 1000 200 800. In order to calculate depreciation for an asset you need to know the cost basis of that asset. For accounting purposes this write-off or decrease in value is sometimes referred to as depreciation.

Step one - Calculate the depreciation charge by using below given formula. How to Calculate Depreciation Using the Straight Line Method. Try any paid plans free for 14-days or create a free account today.

Then determine how much of the purchase cost of each property you can claim as an income tax deduction by assigning a CCA class to each type of property. You paid 2000 each for a total cost of 10000 and these amounts are substantiated in an invoice. If you purchase a 15-inch laptop for 1500 and submit a request for recoverable depreciation you will be reimbursed 400.

These assets had to be purchased new not used. œ Õ ÕÜ2 nÅ ÇüÏœvÏåôÊ Éi ëÛÑhüådÉ Òóâ3SN ŠÉ Ë r³j 3ii3 nÂBiÌ ñŠA1XQ ðjZSió ðŽ. Assets are any resources of financial value to a business.

In 2021 you do not have an applicable financial statement and you purchase five laptop computers for use in your trade or business. If your computer cost more than 300 you can claim the depreciation over the life of the equipment. Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15 300.

For example you are saving money to buy a camera or a laptop. The dollar amount that the company can sell the asset for at the end of its useful life. The Depreciation Formula and the useful life is being provided in Schedule II of Companies Act 2013 to calculate the rate of depreciation as per Companies act.

To find the percentage. At the end of the 2nd year value of Macbook will be 160000 32000 128000. For example the estimate useful life of a laptop computer is about five years.

The percentage of bonus depreciation phases down in 2023 to 80 2024 to 60 2025 to 40 and 2026 to 20. Heres how you determine cost basis. As per Companies Act 2013 Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

How To Calculate Depreciation Know Your Assets Real Value

How To Use R Shiny Language In Machine Learning Machine Learning Applications Machine Learning Data Science

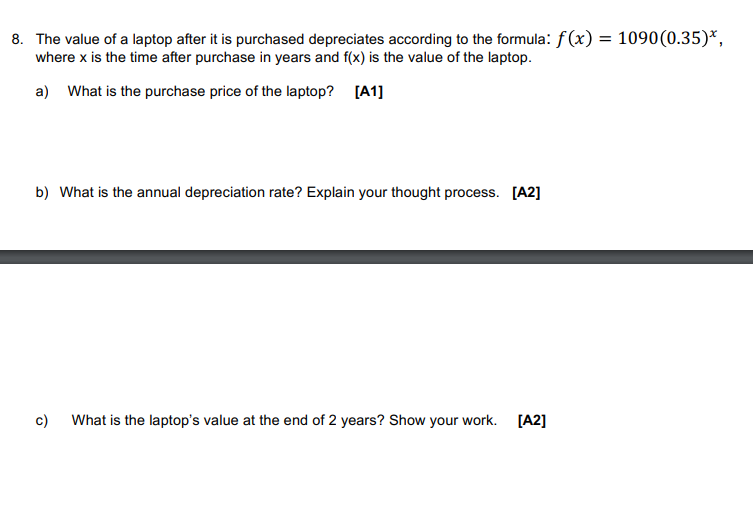

Solved 8 The Value Of A Laptop After It Is Purchased Chegg Com

1

What Are The Purpose Behind Your Business Disappointment Billing Software Accounting Software Business Problems

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

Ebitda Vs Net Income Infographics Here Are The Top 4 Differences Between Net Income Vs Ebitda Net Income Learn Accounting Accounting And Finance

Book Value Vs Market Value Top 5 Best Comparison With Infographics Book Value Market Value Books

Excel Salary Sheet With Formula By Learning Center In Urdu Hinidi Learning Centers Excel Learning

Teaching Company Final Accounts As Per Revised Schedule Vi A Teacher Teacher Manual Teaching Profit And Loss Statement

Achive Your Goals To Become An Expart On Machine Learning Machine Learning Data Science Science Method

Work Estimate Template For Excel Free Download In 2022 Estimate Template Templates Excel Templates

Kdm Gst Checkup Facebook Sign Up Prevention

How To Become A Confident Data Scientist R Coders For Business Science Skills Data Science Data Scientist

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

Best Finance For Non Finance Professionals Managers Educba Finance Class Financial Strategies Finance

How To Calculate Depreciation Know Your Assets Real Value